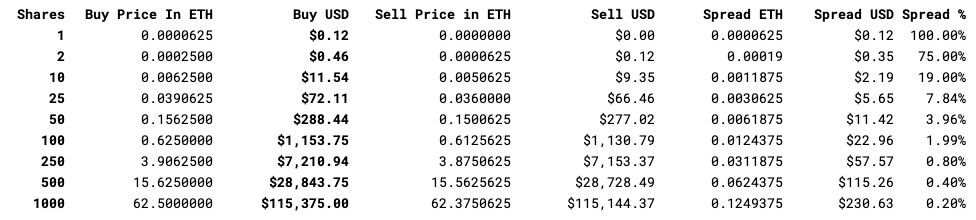

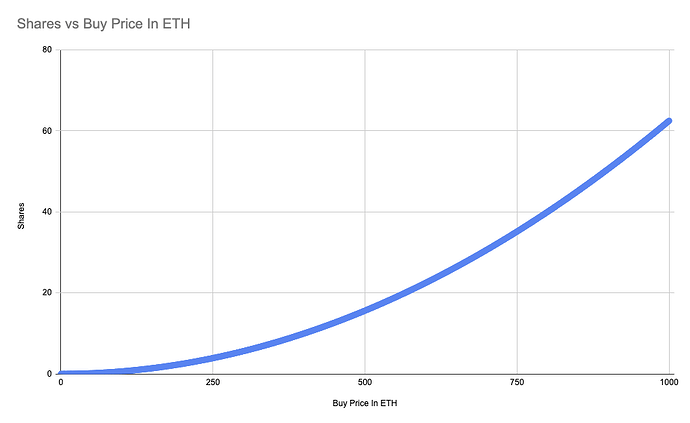

Some key takeaways about the pricing model. The price increases exponentially, based on the no. of outstanding shares.

- There is a potential problem with this:

The 500th member will have to pay ±15.6Ξ to join a room, 250th member = 3.9Ξ, 100th member = 0.625Ξ. - This encourages smaller groups, and perhaps the creation of alt-groups.

The sell price starts at 0 for 1 share, then it’s always the previous buy price. This means you can’t profit from buying and instantly selling 1 share.

- The model incentivises buy & hold rather then quick flips.

The spread USD value is higher when fewer shares are outstanding. Total fees are 10%.

- The protocol fee is set at 5%.

- The other 5% goes to the room owner.

- With 10 outstanding shares, the spread is 19%.

- With 50, it’s 4%.

- With 250, it’s 0.81%, lowering to 0.2% at 1000 shares.

Overview by milestone

Buy Price in ETH @ N outstanding shares

Source data: Google Docs: Price Model